- Handsome Finance

- Posts

- It's weird but I like it

It's weird but I like it

And you might do..

Ever seen a head-scratching peculiarity in the crypto market and thought, "What the heck is going on?" Let me share a perfect example of such a crypto oddball situation that could do you good to understand.

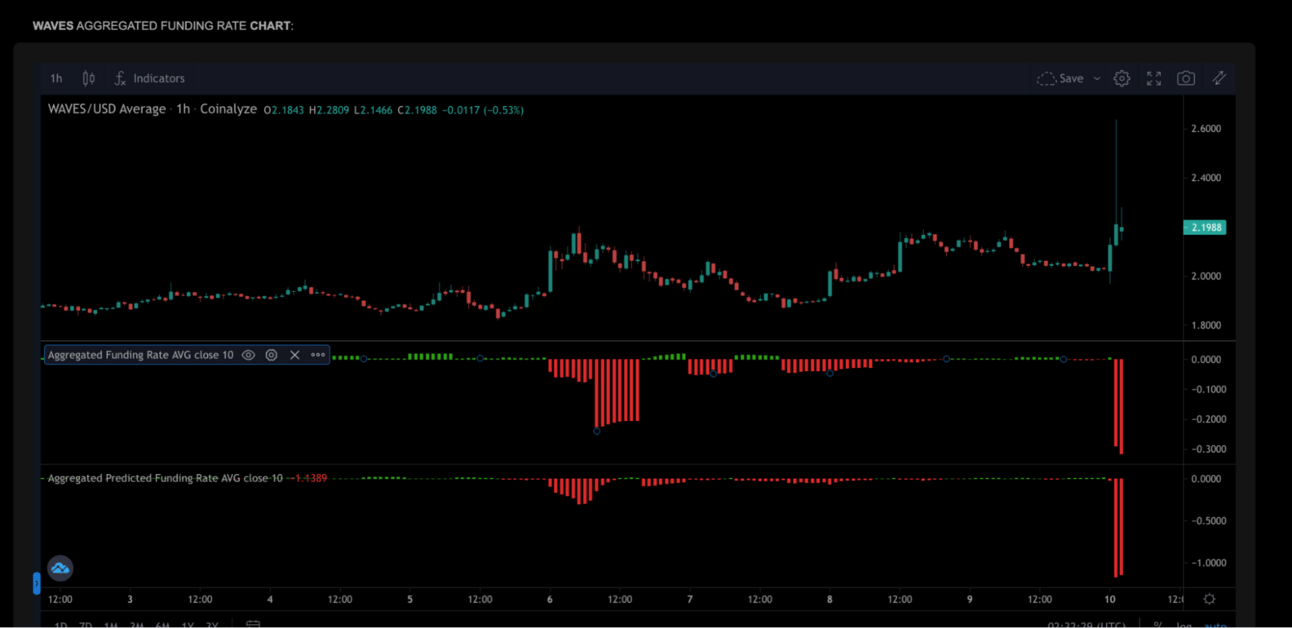

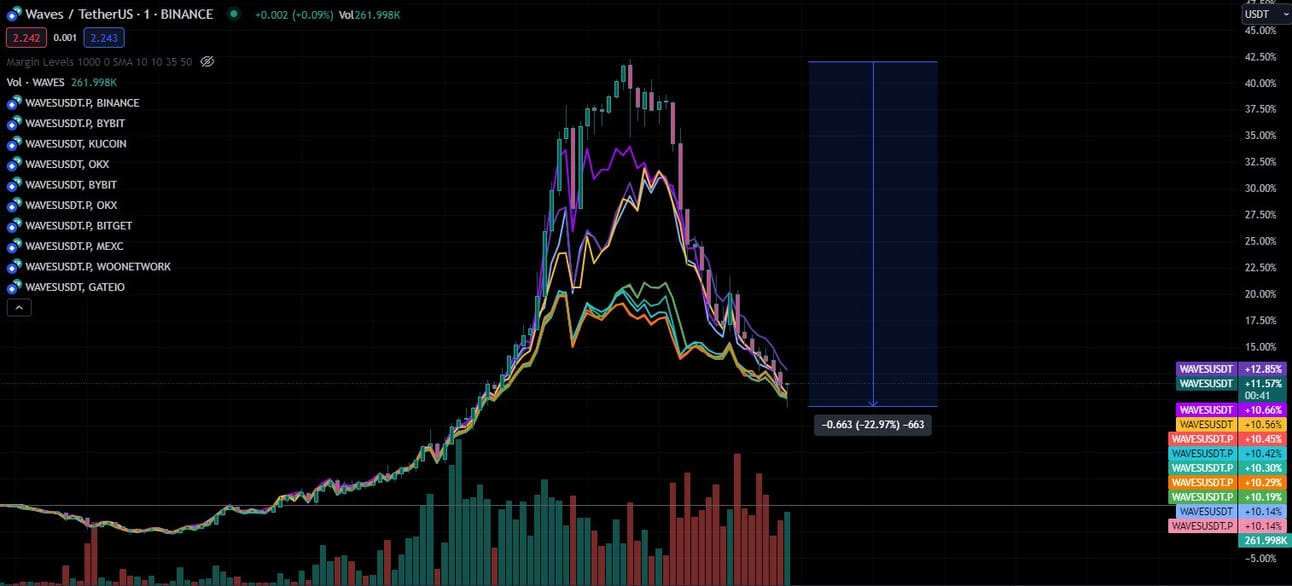

Imagine waking up one morning, and the WAVES (the crypto, not the cool thing to surft) price on Binance is sky-rocketing compared to OKX or Bybit. Now, to make things even weirder, the spot price is zooming past the perpetual futures price.

It just doesn’t have any senses.

For those not deeply immersed in the world of crypto trading, let me fill you in on the "funding rate". It's basically a nifty tool that ensures spot and futures prices stay tied together, preventing some manipulative schmuck from messing with the price. Because, of course, we all know that crypto enthusiasts despise price manipulation, right? insert eye roll here

For a fleeting few hours, you could've earned a whopping 1000% per year annualized for simply going long. But here's the catch, this windfall was due to a lack of available spot borrow on Binance. Without it, someone could've gone long on the futures and short on the spot, raking in that 1000% risk-free.

This opportunity exists alright, just not ON BINANCE. Meaning, you could've gone long on Binance futures while shorting the spot somewhere else. Borrowing funds on-chain, totally undercover. Shifting between exchanges, totally undercover. Sounds like a challenge, right?

Though "in theory", your profits on the long should balance out your losses on the short, leaving you with a sweet interest payment. However, there's a catch. You need to manage margin and ensure adequate capital on both venues for safety. So, this "free money" requires a heap of monitoring and managing, and let's not even talk about the risk involved.

So, no, it's not really "free". You earn it by monitoring and managing an inconvenient risk.

And did I mention? This window of opportunity is short-lived... it's already over.

There you go, you now know what a carry trade is. And here's a cool thing: this is exactly what we want to add to our algo. Why, you ask? Well, these kinds of carry trades thrive when the trend isn't doing much, and vice versa. Quite nifty, right?

Before I sign off, I've got a huge announcement. We've just welcomed one of the finest algo traders on earth to help develop more algorithm signals. Meet James, a trend specialist, who's broadened my perspective on markets like no other. You should check out some of his brilliant work at https://robotjames.com/. His piece “how to make money as a random dickhead” is a must-read for every budding trader.

By the way, do you prefer if I talk about mental models to invest better or things like this today?

Let me know.

I'll keep you in the loop. But for now, remember to make money, but keep it lazy.

Antoine